Share

What sets Alloy apart

Feb 20, 2025

We offer a battle-tested identity verification and fraud prevention platform trusted by 700+ leading financial institutions and fintechs to provide cutting-edge fraud detection.

Across the banking sector, fraud attacks cost financial institutions and fintechs billions annually. But, the impact goes beyond direct financial losses. Fraud protection efforts often result in heavy-handed security measures that are known to lose customer trust and drive business away.

The correlation between fraud and customer retention in banking underscores a truth that the financial services industry understands: To avoid loss and reputational damage, financial institutions and fintechs must balance robust security measures — including identity verification, KYC compliance, and fraud prevention — with a seamless customer experience.

This is precisely the challenge that Alloy helps financial organizations solve.

Why leading financial organizations choose Alloy for fraud prevention

When we launched Alloy in 2015, we set out to solve the complex challenges of identity verification, fraud prevention, and fraud detection for FIs and fintechs. Since then, we've continued to build and refine our platform in close lockstep with our industry-leading clients to help them to adapt to evolving threats in the market and seize growth opportunities by streamlining operations, improving “good” customer acquisition rates, and accelerating go-to-market timelines. In the process, we have shaped how financial institutions and fintechs approach risk management in several key ways:

- Alloy’s unified data orchestration approach has led the industry to embrace comprehensive identity risk management solutions that pull from multiple data sources.

- Our automated testing capabilities allow financial institutions to safely experiment with new fraud prevention methods — something that was previously too risky for enterprise banks and other financial organizations.

- We integrated machine learning with traditional rules-based fraud detection, reducing manual review rates to an average of 14% while maintaining security.

- Our standards for identity verification balance security and user experience through intelligent step-up authentication.

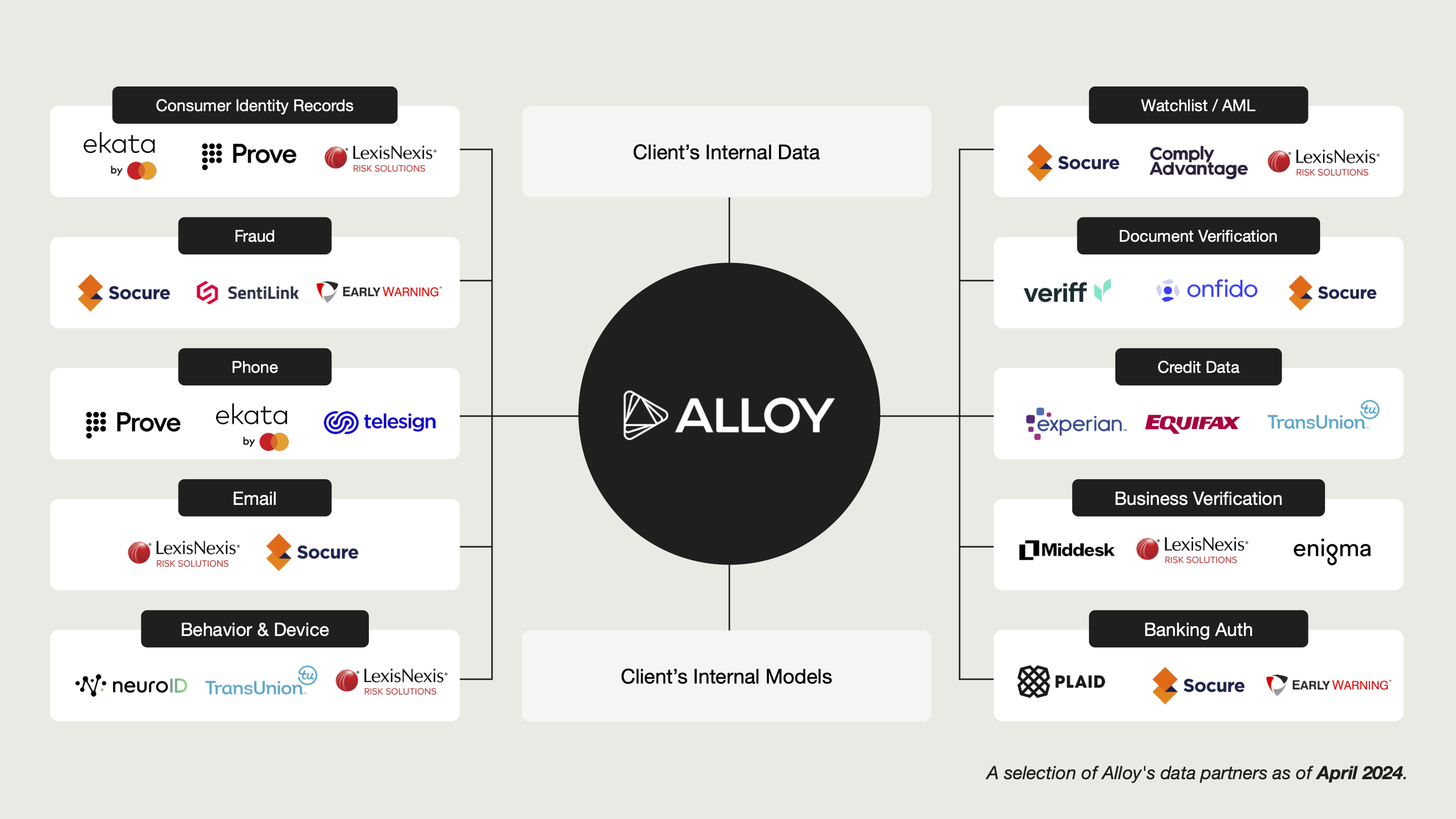

At its core, Alloy is an identity and fraud prevention platform that enables financial organizations to mitigate risk and grow via configurable solutions for fraud, credit, and compliance risk that cover the entirety of the customer lifecycle — from account opening and credit decisioning to ongoing fraud monitoring. We have cultivated the broadest network of data partners to provide a complete, centralized solution that helps our clients understand who they are banking with.

Alloy has been pioneering fraud and identity risk management for the last decade. While many other companies offer fraud prevention tools, Alloy stands out by providing the industry's most comprehensive platform for total identity risk.

Here’s a closer look at how Alloy puts financial institutions and fintechs at the forefront of identity risk management, fraud detection, and fraud prevention:

1. Fight fraud with pre-configured access to 200 partner solutions (and growing) — from device risk to behavioral biometrics and document verification

No single solution will ever be a silver bullet for fraud detection in banking. That's why Alloy's comprehensive approach is so powerful. Unlike traditional fraud prevention and fraud detection systems, we combine and orchestrate data and tooling from hundreds of sources and solutions into one integrated platform, giving you total coverage against evolving fraud attempts.

Today, Alloy has the broadest network of solution partners and pre-built integrations in the industry, with access to fraud prevention datasets trusted by leading financial organizations.

Every data partner offered through Alloy is covered by bilateral agreements — legally binding contracts that guarantee data access, service levels, and support. This is different from the loose co-marketing agreements that many fraud detection solutions advertise, where vendors listed in their data marketplace lack actual technical integration or service guarantees.

For financial organizations, this difference is crucial: when you run a solution through the Alloy platform, you can trust that it's fully integrated, tested, and backed by concrete service commitments.

“Alloy was a no-brainer. Knowing the number of integrations we needed, there was no way we were going to build an end-to-end underwriting solution in-house, so we wanted to turn to a known player in the market.”

- Phil Brosgol, Director of Product Management at Coast

We offer access to more than 15 categories of fraud and compliance data sources, including but not limited to:

- Know-Your-Customer (KYC) and Know-Your-Business (KYB)

- Identity theft prevention

- Device authentication and behavioral biometrics analytics

- Anti-money laundering (AML)

2. Pull the right customer information at the right time with advanced data orchestration

Alloy’s industry-leading data orchestration powers fraud detection by synthesizing traditional and alternative data sources to leverage the right one at the right time. The result is better automatic identity verification and fraud prevention processes for banks, fintechs, and credit unions.

With Alloy, financial organizations can build a picture of their potential and existing customers that goes beyond just credit scores. Once our algorithms detect potentially fraudulent activity — whether behavioral anomalies or unauthorized access attempts — Alloy automatically selects the data source or solution that best fits the risk scenario.

Our secure APIs also connect our clients with the products they need to act on risk. For example, the Alloy SDK enables fraud prevention teams to choose from around a dozen passive and active step-up methods.

This comprehensive approach doesn’t only reduce user friction and fraud. It also enables more inclusive customer decisions, helping financial institutions and fintechs safely serve traditionally underbanked populations, like students and recent immigrants, while uncovering new revenue opportunities.

3. Test new prevention strategies against emerging fraud patterns before pushing anything live

Fraudsters never really go away. Instead, they will continuously probe for new vulnerabilities and adapt their tactics — whether that means inventing sophisticated phishing schemes or engaging in new forms of identity theft. That’s why financial fraud detection requires so much vigilance.

While fraud professionals know this, financial institutions and fintechs can be hesitant to try new solutions, fearing both process disruption and potential reputational damage. Unfortunately, fraudsters count on this hesitancy to turn their newest tricks into fraud trends.

Alloy's Testing Suite and SDK empower you to strengthen your banking fraud detection strategy without risk. Easily test new data vendors, enhance step-up verification processes, and optimize your workflow — all while keeping your digital and in-branch banking experiences friction-right.

Four powerful testing modes

We continuously evaluate new data solution partners to keep our banking fraud detection capabilities at the cutting edge. Alloy’s Testing Suite enables you to do the same with confidence. We offer four different types of fraud testing at Alloy: end-to-end application testing, backtesting, A/B testing, and shadow testing.

Together, these testing modes and partner options help our clients identify potential fraud patterns in real-time for optimal fraud management.

"The intuitive navigation of the Alloy Testing Suite allows me to safely make changes on an ongoing basis without worrying about ‘breaking’ anything and empowers me to make changes autonomously."

- Brandon White, Senior Data Analyst at Ent Credit Union

4. Deploy end-to-end banking fraud detection across customer touchpoints

Alloy’s unified approach to fraud detection in banking makes us the most comprehensive fraud solution on the market. While fraud detection tools for banking only handle transaction monitoring or basic anomaly detection, Alloy’s comprehensive solutions automatically identify and prevent fraud risk at every stage of the customer journey:

- At onboarding and origination — Streamline initial fraud detection and identity verification for consumer and business customers. Keep KYC/KYB compliant and protect against first-party fraud when customers apply for new products or services like a bank account or credit card.

- In real-time throughout the customer lifecycle — Continuous monitoring evaluates each customer's account for fraud risk, empowering real-time responses to anomalies in transaction data, from deviations in normal credit card purchases to account takeovers and other forms of fraud. And as existing customers apply for additional products like personal loans, Alloy remains in the background, performing perpetual KYC and KYB, so you have accurate and updated risk profiles to base your decisioning on.

Applying end-to-end customer protection like the kind Alloy provides makes it harder and more expensive for fraudsters to act out scams and financial crimes like account takeover fraud (ATO). With Alloy’s fraud detection and prevention tools, financial organizations are well-equipped to run financial criminals out of business.

Under a fraud attack? Alloy’s dedicated team has your back.

5. Leverage battle-tested solutions based on the collective experience of over 700 financial institutions and fintechs, including 25% of the top 25 US banks.

At Alloy, we provide over 700 clients with strategic guidance, from selecting optimal data vendors to implementing identity and fraud prevention workflows. Our knowledge helps financial organizations achieve the perfect balance between fraud detection, compliance, and customer experience. Not only has this history informed how we build and iterate on our product, but it also enables us to provide expert hands-on guidance to our clients.

Our experience across so many clients also allows us to build advanced machine learning algorithms that detect emerging fraud patterns and automate responses. In turn, we enable financial institutions and fintechs to scale their fraud prevention while reducing manual workload. What’s more, our machine learning models continuously improve fraud detection accuracy while reducing false positives — something traditional rule-based systems can't achieve.

Perhaps this is why clients like Live Oak Bank view Alloy as a trusted partner more than just a vendor.

"Whenever we're looking to update our KYC, KYB, or fraud checks, the first thing that we do is reach out to Alloy. Alloy has made the process of navigating new vendors quick and painless."

- Will Haynes, SVP of Embedded Banking Product Leader at Live Oak Bank

From credit card and payment fraud to synthetic identities and bot-driven social engineering attacks, financial crime evolves daily. Having a partner who understands the nuances of fraud investigation, detection, and prevention is more critical than ever. Alloy's expert guidance helps financial organizations not only stay ahead of emerging threats but also maintain the agility to protect each product line.

Check out more of our client case studies here.

So, what sets Alloy apart?

In a market saturated with single-purpose fraud detection solutions, Alloy stands as the industry's most comprehensive identity and fraud prevention platform.

We've revolutionized fraud detection software by bringing together the industry's most innovative intelligence sources and solutions through our proprietary data orchestration layer. Our platform unifies over 200 pre-built integrations with AI-powered analytics and omnichannel capabilities, enabling financial institutions and fintechs to enrich and act on identity data in real-time through a single, powerful platform.

The result is more than just effective fraud detection: it allows banks, fintechs, and credit unions to transform their fraud prevention strategy into one that delivers the seamless experiences modern customers desire.