Share

Fintech needs business model innovation

Feb 18, 2017

I love fintech, but fintech got problems. Financial technology has plenty of hype, with many going as far as to say banks are going to have an "Uber Moment" where they are fully disrupted by technology driven companies. This sounds great, but there's an obvious problem: nobody is actually allowed to compete with banks. There are over 6,000 FDIC insured banks in the US, but only 3 new charters have been issued since 2010. The option to compete with banks directly has been removed by the federal government, and with it the opportunity to build a "Full Stack Startup" like Uber.

But it gets worse!

Many technology innovations are regulated away as well. Innovative ideas to improve underwriting, customer onboarding, and more are hamstrung by regulations that were written for branch banking and communication by mail/phone/fax. One of my favorite examples is that using machine learning to underwrite consumer credit can violate the FCRA if its methods aren't reproducible to a regulator. We're left with an industry expecting a technology driven "Uber Moment" in an industry where Uber's strategy is banned and where technology innovation is limited. That's a big problem.

Tommy Nicholas

Co-founder @ Alloy.co

"We're left with an industry expecting a technology driven "Uber Moment" in an industry where Uber's strategy is banned and where technology innovation is limited. That's a big problem."

Consumer fintech is too important to let these road blocks halt innovation entirely. Fintech companies provide a systemic check on the government-protected banking oligopoly in an era where community banks are shrinking in numbers and influence. However, for consumer fintech to remain a sustainable source of innovation, it is important that there be breakout consumer fintech success stories (>$10B). But where do breakout consumer fintech winners come from? Because fintech companies can't compete directly with banks, they first need to find an product opportunity that banks are ignoring. However, this is rarely sufficient. The reason the opportunity was being ignored in the first place is typically because it doesn't fit into the existing business models of the incumbents. Consumer fintech breakout winners must combine a product/market opportunity legacy FIs have missed with a business model innovation that makes the business sustainable.

Financial services business models: a thrilling history

To understand "business model innovation", it's important to distinguish it from "product innovation" or "technology innovation". A business model innovation is a change to either the infrastructure that allows a company to deliver its product to customers or who/how the company charges for the product.

There are 5 traditional business models in consumer financial services:

Lending / Interest: the bank lends money and is repaid the amount they lent (the principle)+ a fee based on the amount and duration of the loan (interest).

Fees / Retail Banking: the bank provides deposit/payment accounts and charges fixed monthly or transactional fees for their services.

Assets Under Management / Advisory: an investment advisor or fund manages an individual's money and charges a % of the total assets they're managing.

Interchange / Payments: a payment network or service facilitates the movement of $$ from one entity to another and charges a fixed fee + a % of the money moved.

Commissions / Brokerage: a broker facilitates the exchange of a security between two parties and charges either a fixed or % fee for facilitating the trade.

These models all start out simple and direct, providing a service to consumers and charging the consumer directly for the service. Seemingly simple changes to these models can have profound consequences, making existing products significantly more profitable or supporting the growth of entirely new products. The $$ these changes can unlock is best illustrated by looking at the evolution of payment processing and interchange over the last 100 years.

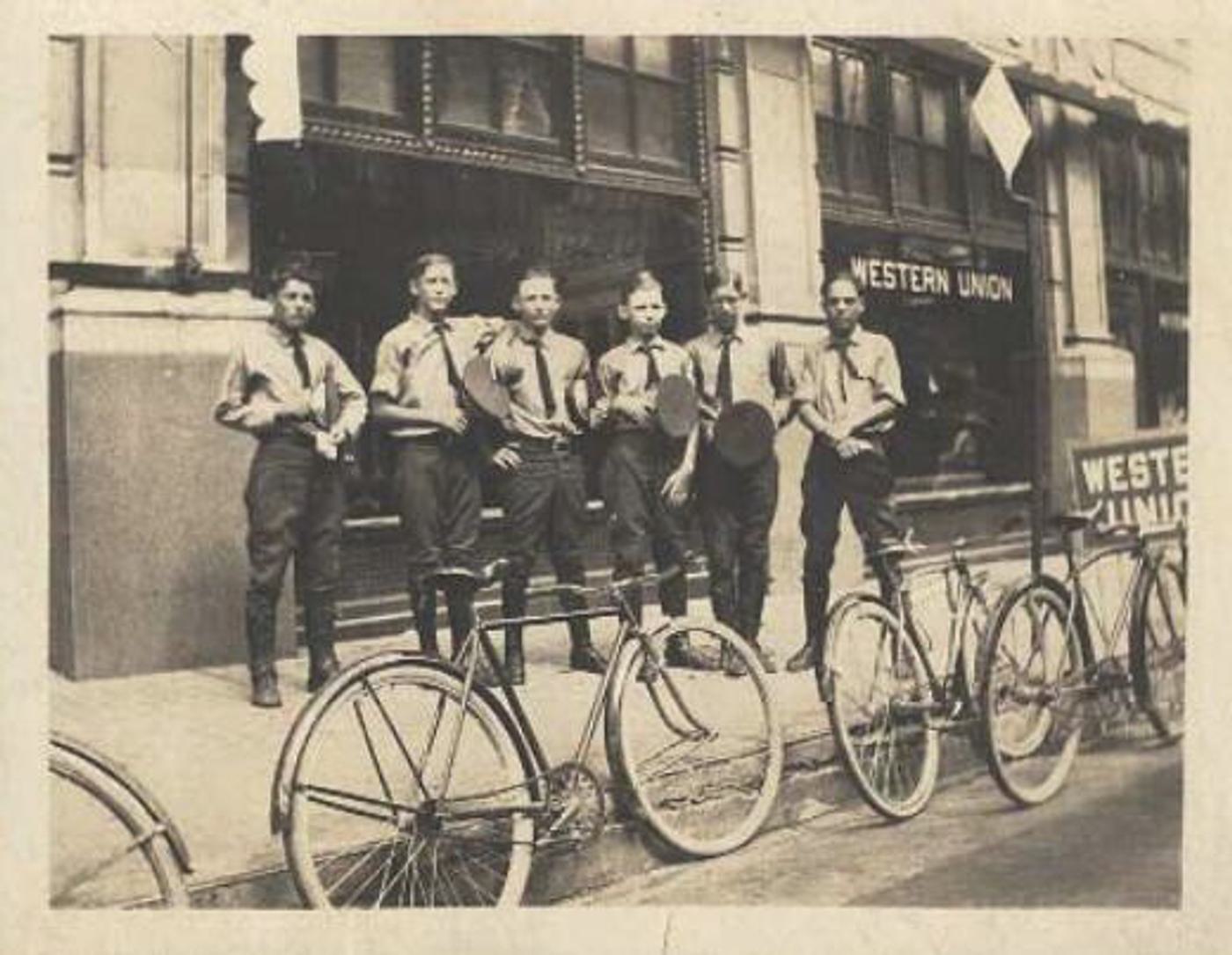

Interchange innovation pt. 1: Western Union (used to be innovative!)

The "payments" industry really began with Western Union. Western Union began as a telegraph service in 1851, but in 1871 it introduced a money transfer service based on its telegraph infrastructure. People anywhere in the country could now bring cash into one Western Union location and have someone at any other Western Union location pick up the same amount of cash in just a few minutes. This was the first time in history people could send money to each other without physically transferring the cash, and boy was it popular. Western Union charged the sender of the cash directly for the service, and it built a phenomenal business. In 1914, Western Union did something interesting: they issued the first ever "charge card", allowing people to pay for their services without actually having cash on them. The card was created simply to grow their existing business, but what they didn't realize was they had created a product that would soon make their business far less important.

Interchange innovation pt 2: VISA spreads "everywhere you want to be"

In 1958, Bank of America launched the "BankAmericard" credit card, and soon after Wells Fargo and 5 other banks' launched a competitor called "Master Charge". These companies are known today as "VISA" and "Mastercard", and they made payments as we know it possible. VISA/MC allowed card holders to pay with their cards at any business that joined their network, something we take for granted today. This required a series of miracles, several decades, and a visionary de-centralized network to work. However, more than anything it worked because of an incredible business model innovation. Both VISA and Mastercard realized that while there was SOME value to the consumer in being able to pay without cash, the value to the business was even larger. If consumers could pay without cash, they bought WAY more stuff and gave businesses more $$. VISA/MC decided not to charge the customer for payments, but rather to charge the businesses ~2–3% of every payment made on the network. VISA/MC keep about 1/10th of that, and the rest is distributed to the bank that issued the card. This incentivized banks to push cards to consumers, consumers to use them, and banks and service providers to aggressively push businesses to accept them. The results have been stunning. VISA and Mastercard move over five TRILLION dollars every year across their networks and have a combined market cap of over $300 BILLION. Western Union's market cap, for comparison, is $9b: that is the power of business model innovation.

Interchange innovation pt. 3: Paypal (not just ugly payments buttons!)

Paypal took VISA's innovation a step further to create the biggest winner in the "internet fintech" era. Paypal's product innovation was simple yet profound: allow people to securely pay for things online. Paypal's business model innovation, however, was just as important. Paypal has consumers create accounts with Paypal, syncing their bank accounts and credit cards into Paypal's system and then letting them pay for future transactions simply by logging into their Paypal accounts. This was done initially for security, trust, and user experience reasons, however, this has allowed for two massive innovations to their business model.

First, while Paypal charges the business receiving the payment the standard ~3% transaction fee, Paypal ultimately settles the payment however the consumer chooses. Paypal makes the default payment choice ACH (which costs Paypal ~$0.00) rather than card payments (which cost them ~2%). This means that Paypal makes 300% more when a customer pays with ACH vs a card, giving Paypal unprecedentedly huge margins for a payments company. Second, Paypal can process payments globally more seamlessly than any other company in history. Because Paypal "clears" payments internally and not directly through any particular network, Paypal can allow people to transfer money anywhere in the world with very low friction. Paypal had to make relationships with banks and networks everywhere in the world to facilitate this, but to the consumer and the business, every Paypal payment or money transfer feels like any other Paypal payment, no matter where in the world it occurs.

These business model shifts have allowed Paypal to scale their business globally faster and with better margins than any other payments business since VISA. The result is a market cap of $50b despite the fact that many consumers and businesses loathe the company. No traditional "point of sale" payments company, such as Vantiv (~$12b) or First Data (~$15b), has a market cap that even comes close to Paypal's, despite being dominant companies in a much bigger market.

What's next for fintech business model innovation

The power of business model innovation is clear from history, and it's becoming even more important as traditional business models are being eroded by competition and regulation. It isn't surprising most of the winners in the post-financial crisis "fintech unbundling" era have paired innovative products with innovative business models. These innovations take two forms: changes to existing business models to unlock new value and the application of business models from other industries to a financial services product.

Changes to legacy business models

Affirm is perhaps the best example of a fintech company shifting an existing business model to unlock new value. Affirm allows consumers to finance large e-commerce purchases (such as a mattress) and then pay off the purchase in installments over time. Traditionally, "point of sale" financing is treated like a regular consumer loan, where the lender makes money when the customer pays back the loan. Affirm, however, does not charge the consumer for the loan, and instead charges the business for the benefits they get by integrating Affirm. It turns out the business has more incentive to offer the service for free than the customer has to pay for it, and this alignment of incentives has allowed Affirm to grow incredibly rapidly.

There will almost certainly be huge winners propelled by successful changes to existing business models. One candidate I find fascinating is the "Found Money" program from Acorns. Acorns is a mobile robo-advisor that helps new investors automatically invest small amounts of money every day. They use a variation of the classic AUM business model, charging the customer 0.25% of the assets they manage (minimum $1/month). However, their "Found Money" program does something new: brands now can invest money into their customers' Acorns accounts directly as a purchase incentive instead of traditional incentives such as discounts or cash back. This has a few obvious effects: increasing the assets Acorns is managing and giving Acorns a free channel to new accounts. The #1 problem robo-advisors have is the cost to acquire new accounts and their #2 problem is getting people to actually put money into those accounts. This solves both of these problems for Acorns, and has the potential to radically alter their unit economics and ability to scale.

New business models

If small changes to old business models can catalyze that much innovation, then the introduction of entirely new business models to financial services will likely have an even larger and more far-reaching impact. The most well-documented example from the last 10 years is the introduction of the "marketplace" business model to the lending industry. Companies like Lending Club and Prosper facilitate loans to consumers by matching them directly to investors (either individuals or institutions) that want to lend them money. Lending Club shares a small % of the interest on the loan with the investors, allowing them to rapidly grow the number of loans they make without needing an internal source of funds such as checking/savings account deposits. Despite the challenges they've faced recently, Lending Club is still a public company with a $2.3b market cap. Companies like SoFi (private valuation $4b) have used a similar marketplace model to bootstrap growth are continuing to grow quickly.

There are other interesting examples of new business models that have achieved significant scale, such as education products that monetize by referring their users to other products (Credit Karma $3.5b / NerdWallet $550m). These products allow companies to give great products that help consumers make smart decisions for free while still building great businesses, and it's now clear this will not stop simply with financial education. I believe there are many potential candidates to be the next new business model to create a billion dollar fintech company. Here are some of my favorite ideas:

Subscription: Charging consumers directly for products or services as a subscription is not entirely new (they call them "free checking accounts" because they weren't always free), but it's definitely gone out of fashion. This is largely because so many legacy financial products have become commoditized with no differentiating features a user would want to pay for. Fintech companies should strive to do better. Robinhood Gold one such effort, allowing users of their free stock trading app to get access to faster payments and trading margin for a fixed monthly fee. Aspiration's checking account takes a more radical approach, allowing customers to choose a set fee to pay every month for their service. These models will work best for companies with sticky products consumers actually love and use daily, creating an alignment of incentives between company and you rarely see in the financial world.

Direct commerce: Typically, when a consumer decides to buy something, they first decide what they want to buy, second where to buy it, and THEN how to pay (cash, card, loan, etc). I believe there are opportunities to invert this process. The Starbucks app has already proven how making payments easier can drive consumer decisions and loyalty. If networks like Apple Pay and apps like LevelUp are able to prove they can drive purchasing decisions rather than just facilitating payments, the money they will make will be huge. There are even more fascinating opportunities for this payment/purchase inversion in lending. When buying a car, for example, credit unions typically finance purchases after you've already chosen both a car and a dealer. I learned recently of a credit union in New Jersey that is doing the reverse: giving you the financing first and then finding you the best deal on the car you want. If you trust your credit union and don't trust car dealers, going to the credit union first doesn't seem so crazy if they make the experience seamless and get you a great deal. The credit union can then give you low or even 0% financing, instead collecting a referral fee from the dealer for selling the car. Expanding on this idea could power some huge winners and I'm excited to see any company that takes this approach.

Data: "we'll sell our data" is the classic mantra of a startup without a real business model. However, in financial services it truly is possible that a company could create data that was valuable enough to support a big business. Foursquare is already accomplishing this in social networking despite a dying consumer service, and there will be at least one winner in fintech as well. Matt Turck does a great job explaining the positives and negatives of this model which is a great read for those that are interested in learning more.

So what?

Ok so business model innovation is important, maybe even critical, to building a breakout consumer fintech company. But what about all the companies that are offering innovative new products but are using legacy business models? These companies almost always find that a "better product" isn't enough to drive mass adoption and typically charge far less than the incumbents to differentiate themselves and accelerate growth. I believe these companies will not survive without successfully implementing new ways of making money because raising prices is hard and their margins today are too thin. Robinhood certainly fell into that category with their commission-free trading accounts, and we can already see that their efforts to build a different monetization model are well underway. Companies I believe will introduce new business models in the next 3 years include most robo-advisors (Wealthfront, Betterment), Savings apps (Qapital, Digit), and even some lenders (SoFi in particular I expect big things from). Some of those companies can survive with no change to their businesses, but I believe for the most part the level of innovation in their business models will determine whether or not they are truly transformative businesses or not.

Business model innovation is a big deal, despite how little attention it gets relative to product and technology innovations. Fintech's unique challenges make it even more important, and it's clear to me that tracking business model innovations will be at least equally important to making products people actually love for the next stage of the consumer fintech boom. Send all questions and positive feedback to me on Twitter and all complaints and criticisms here (jk).

Thanks to Vaibhav Puranik, Alex Hardy, and Charles Hearn.